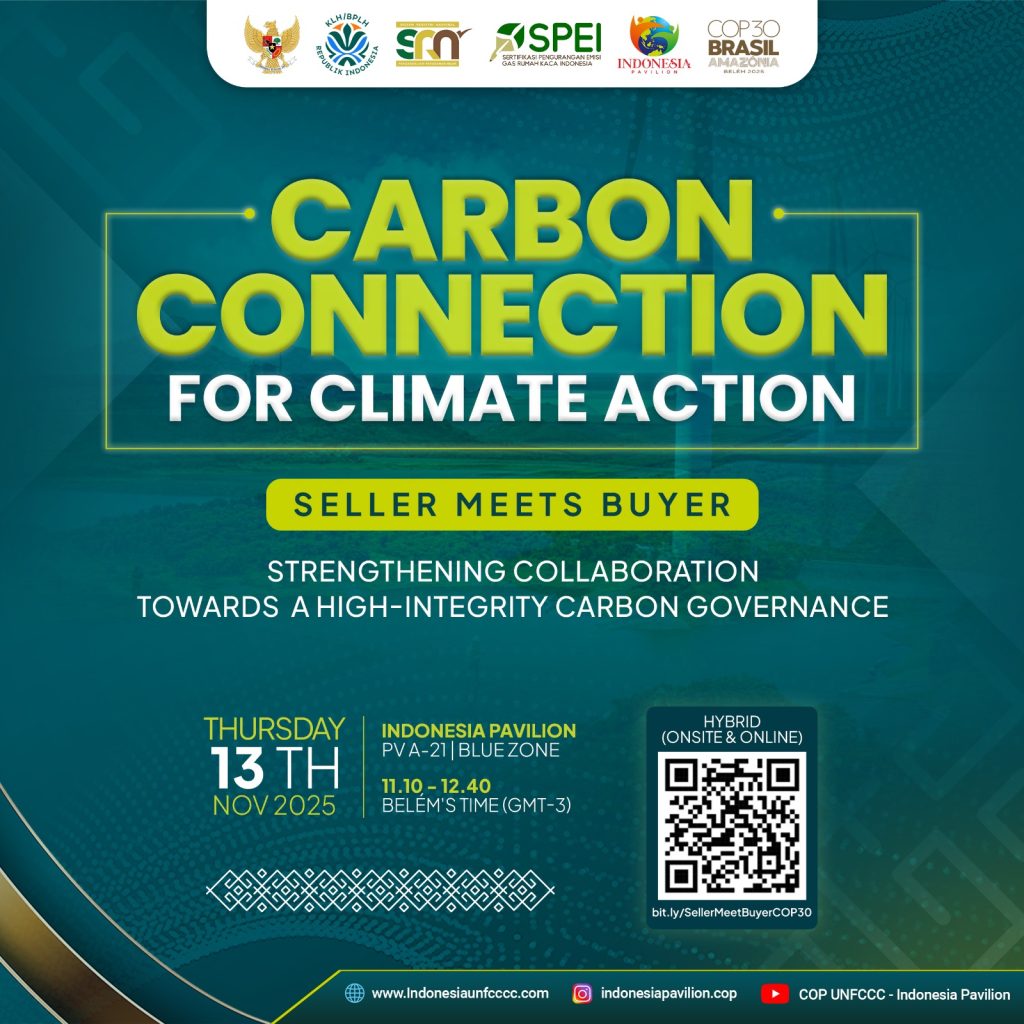

CARBON CONNECTION FOR CLIMATE ACTION

Session > CARBON CONNECTION FOR CLIMATE ACTION

About

A. Background

The 2025 UN Climate Change Conference-Belem (COP30/CMP20/CMA7) provides Indonesia with a significant opportunity to demonstrate its readiness and capability to participate in the global carbon trading system. With the theme "Accelerating Substantial Actions of Net Zero Achievement through Indonesia's High Integrity Carbon," the Indonesian Pavilion plans to showcase concrete projects, build stronger partnerships, and foster meaningful discussions among parties and partners involved in the carbon market. The "Seller Meets Buyer" event is specifically designed as a leading, business-focused platform to effectively connect carbon credit providers with those who threaten them.

IDXCarbon has been awarded as Carbon Positive Awards 2025 by Green Cross United Kingdom, thus the purpose of this session is to connect IDX-listed companies, IDX member companies, and users of carbon exchange services, which act as providers of high-quality carbon units, with potential buyers from around the world. These buyers can include international corporations, financial groups, global organizations, and governments seeking credibility in achieving their climate targets aligned with the SPEI/SRN/Indonesia Scheme. By providing a hosted space for presentations, live discussions, and individual meetings, this session seeks to create significant opportunities for sustainable agreements, joint projects, and alliances.

Crucially, this session focused on implementing the plan, rather than simply discussing potential outcomes. The ultimate goal was to achieve tangible business outcomes by providing the resources and support needed for broader and more inclusive international carbon trading. By focusing on implementation, this event ensured that Indonesia's engagement would result in measurable progress, stronger partnerships, and sustained collaboration with stakeholders worldwide.

Besides making transactions easier, the Seller Meet Buyer event also helps to create transparency, confidence in the market, and a shared understanding of how Indonesia’s carbon market works. It highlights Indonesia’s proactive steps to bring its own rules, policies, and private sector involvement into line with global standards under Article 6 of the Paris Agreement. This alignment ensures that carbon credits issued by Indonesian organizations meet strict verification standards and truly help to reduce emissions.

Additionally, by making the Pavilion a center for sharing knowledge, exploring investment opportunities, and encouraging international teamwork, the session strengthens Indonesia’s broader climate diplomacy efforts. It emphasizes that Indonesia is dedicated not only to lowering its own emissions towards a low-carbon and climate resilience development, but also to taking a leading role in the growth of sustainable and trustworthy global carbon markets.

In conclusion, the Seller Meet Buyer event at COP30 is expected to produce clear business outcomes while improving Indonesia’s position in the international carbon market. By connecting sellers and buyers in a professional and transparent environment, the session will help turn climate goals into practical partnerships, promoting both global climate solutions and Indonesia’s long-term sustainable economic growth.

B. Objective and Output

-

● Objetives:1. To facilitate business-to-business (B2B) meetings between Indonesian entities and international carbon credit buyers.2. To broaden market access for Indonesian companies participating in carbon trading.3. To showcase Indonesia’s capability in supplying credible, verified, and internationally recognized carbon units.4. To introduce the carbon market governance and its modalities.5. To support Indonesia’s climate diplomacy and economic engagement in the COP30 forum.● Outcome:1. At least one seller-buyer session held each day throughout COP30;2. Establishment of MoUs/LoIs or exploration of new partnerships in carbon trading;3. Promotion of the Indonesia Pavilion as a showcase hub for carbon market opportunities; and4. A follow-up action list to strengthen Indonesia’s position in the global carbon market.

C. Target Audience

D. Session Format

- 10 – 21 November 2025.

- Daily, 1 hour slot dedicated to seller-buyer engagement.

- Hybrid format (onsite and online).

- Scheduled match-making meetings and open networking opportunities.

Key Messages

"Carbon Connection for Climate Action: Seller Meets Buyer" marked a historic milestone in Indonesia’s climate finance journey . The session transitioned from policy discussions to concrete transactional partnerships, highlighting Indonesia’s readiness to supply high-integrity carbon credits from both nature-based solutions and renewable energy technologies. The event featured landmark agreements between state-owned enterprises and global partners, solidifying Indonesia's position as a premier hub for the global carbon market.

Key Highlights & Strategic Partnerships

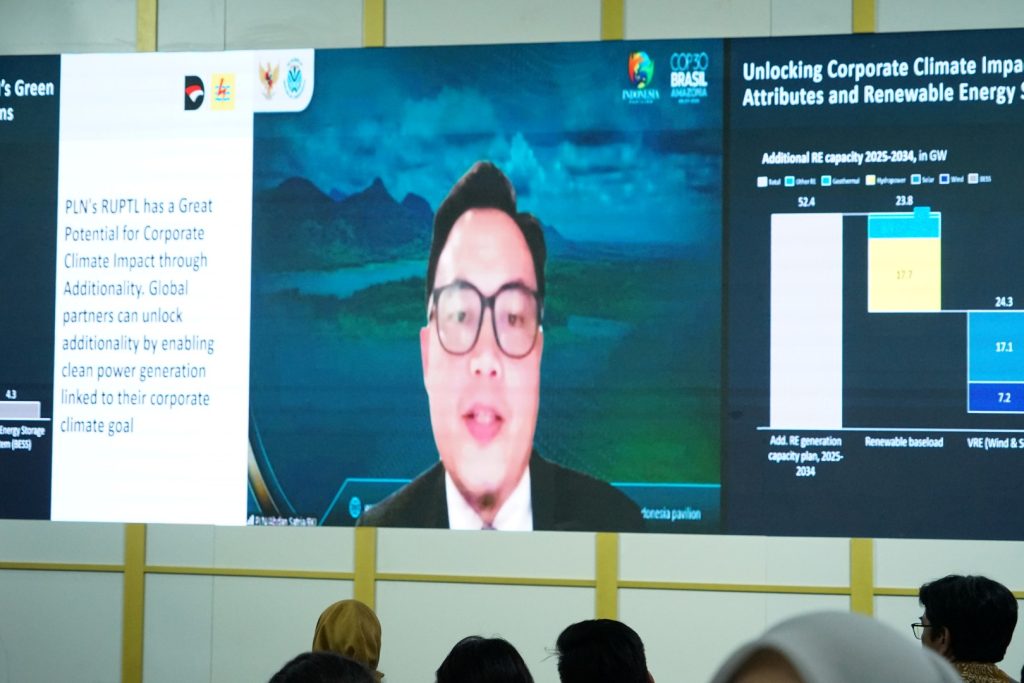

1. Historic Indonesia-Norway Agreement (Article 6.2) A groundbreaking Mutual Expression of Intent (MoI) was signed between PT PLN (Persero) (representing Indonesia) and the Global Green Growth Institute (GGGI) (representing Norway) .

• The First of Its Kind: This is the first and largest bilateral cooperation under Article 6.2 of the Paris Agreement for technology-based projects in Indonesia, specifically targeting renewable energy like floating solar PV .

• Impact: The partnership targets an emission reduction of 12 million tons of CO2e, with a potential transaction value in the hundreds of millions of USD over a 10-year period.

• Innovation: It introduces a "Generation-Based Incentive" scheme to bridge the financial viability gap for renewable projects.

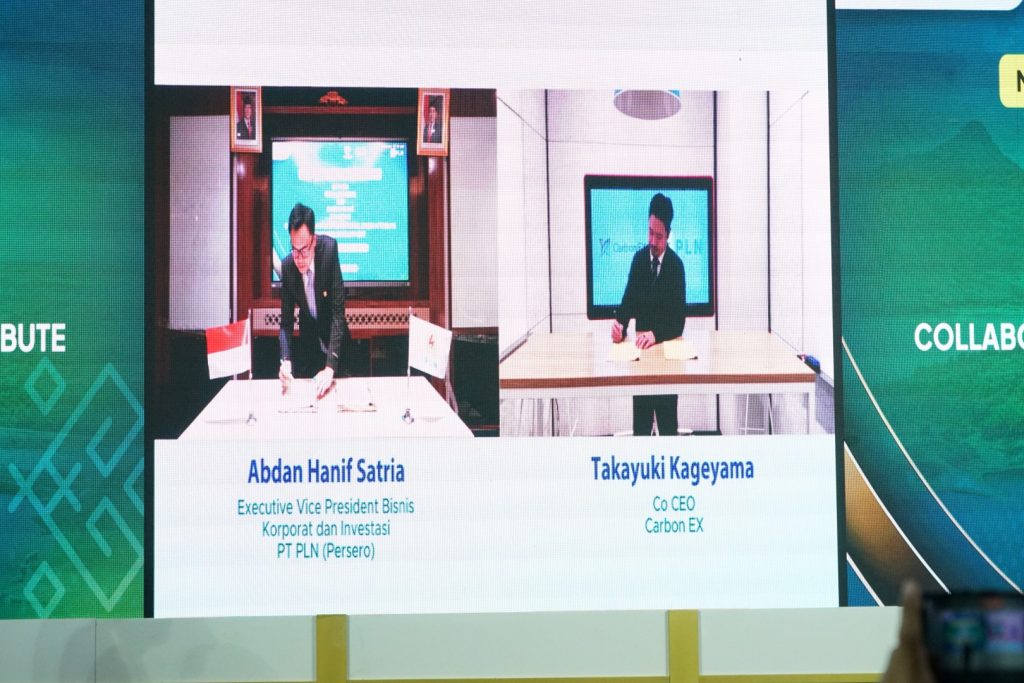

2. Expanding Market Access: PLN & Carbon EX PLN expanded its reach into the East Asian market by signing an MOU with Carbon EX, a Japanese trading platform.

• Objective: To accelerate the trading of Renewable Energy Certificates (RECs) and carbon offsets between Indonesia and international buyers, particularly facilitating access to Japan’s GX League.

• Portfolio: PLN announced a 1 GW renewable energy portfolio ready for corporate offtake, including major projects like the IKN Solar PV (50 MW) and Asahan III Hydro Power (174 MW).

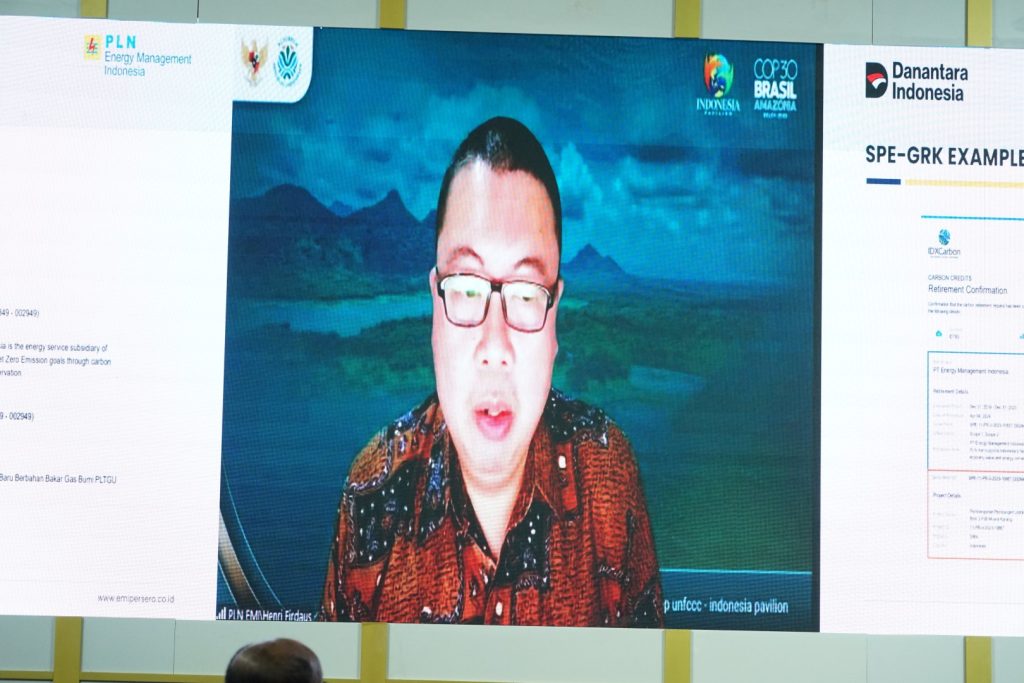

3. Circular Economy in Agriculture: PalmCo (PTPN IV)

PalmCo showcased its leadership in the waste sector by transforming palm oil mill effluent (POME) into biogas electricity .

• Achievement: PalmCo is the first state-owned plantation company to receive the Emission Reduction Certificate (SPE-GRK) from the Ministry of Environment, validating its carbon credits for the market .

• Target: The company aims to reduce emissions by 54%, exceeding Indonesia’s national NDC target by 2030.

4. High-Integrity Peatland Restoration: Dassa Corp Representing the private sector, Dassa Corp introduced the "Jaga Planet" project in West Kalimantan, a peatland restoration initiative in partnership with Inpex and Sustainacraft .

• Technology: The project utilizes "Sakala," an AI-driven monitoring system, to ensure transparency and real-time verification of carbon stocks.

• Scale: Dassa offers an annual volume of 2.5 million verified carbon units (VCUs) starting in 2026.

Conclusion

The session successfully demonstrated that Indonesia’s carbon market has matured beyond forestry. With the operationalization of Article 6.2 for energy projects and the entry of certified agricultural carbon credits, Indonesia offers a diversified, high-integrity portfolio for global investors.

Live Stream

Presentations

“Global Mutirão” (collective efforts). The 30th session of the Conference of the Parties to the United Nations Framework Convention on Climate Change. The conference aims to move from ambition to action, with a specific focus on implementation and results-oriented platforms where stakeholders can innovate, invest, and lead to accelerate climate progress.

Contact Us

CENDEKIA MULIA KOMUNIKASI

Crown Palace Blok B 16 Jl. Prof. Dr. Soepomo No.231 Jakarta Selatan 12870

Our Email

sekretariatindonesiapavilion@gmail.com

Our Phone

(021) 8370 3256

Our Fax

(021) 8370 3261

COP 30 Locations

Copyright © 2025 indonesiaunfccc.com All Rights Reserved.